Estate Liquidation

Estate Liquidation

Estate liquidation is the process of selling off all or a significant portion of an individual’s property and assets. This is often done when the owner has passed away, but it can also occur in other circumstances such as downsizing, moving to a different type of housing (like an assisted living facility), or in situations of financial distress. The primary goal of estate liquidation is to convert assets into cash or manageable assets to settle debts, distribute to heirs, or manage in another effective way. Here are the key aspects of estate liquidation:

Benefits of Estate Liquidation

Simplifies Asset Distribution: Converts physical and varied assets into cash, which is easier to distribute among heirs.

Debt Settlement: Provides funds to pay off any outstanding debts of the estate.

Clarity and Closure: Offers a clear and organized way to manage and dissolve the estate, providing closure for the family.

Assessment of Assets

Inventory: Creating a detailed inventory of all assets, including real estate, personal property, collectibles, vehicles, and financial assets.

Valuation: Appraising items to determine their market value. This might involve professional appraisers for highly specialized items like antiques, artwork, or jewelry.

Preparation for Sale

Organizing and Cataloging: Sorting and categorizing items for sale. This may include cleaning, repairing, or restoring items to increase their value.

Marketing: Advertising the sale through various channels, including online listings, social media, local newspapers, and signage.

Sale Methods

Estate Sale: Conducting a public sale, often held at the individual’s home, where items are displayed and sold over a few days.

Auction: Hiring an auctioneer to sell items to the highest bidder. This can be done in person or online.

Private Sale: Selling items directly to buyers, often for high-value items that require a targeted approach.

Consignment: Partnering with consignment shops or dealers who sell the items on behalf of the estate and take a commission.

Handling of Proceeds

Payment of Debts: Using the proceeds to settle any outstanding debts or obligations of the estate.

Distribution to Heirs: Distributing the remaining proceeds to beneficiaries as specified in the will or according to legal guidelines if there is no will.

Estate Taxes: Ensuring any applicable estate taxes are calculated and paid.

Legal and Logistical Considerations

Estate Executor: The process is often overseen by an estate executor or administrator who ensures that the liquidation is conducted legally and in accordance with the decedent’s wishes.

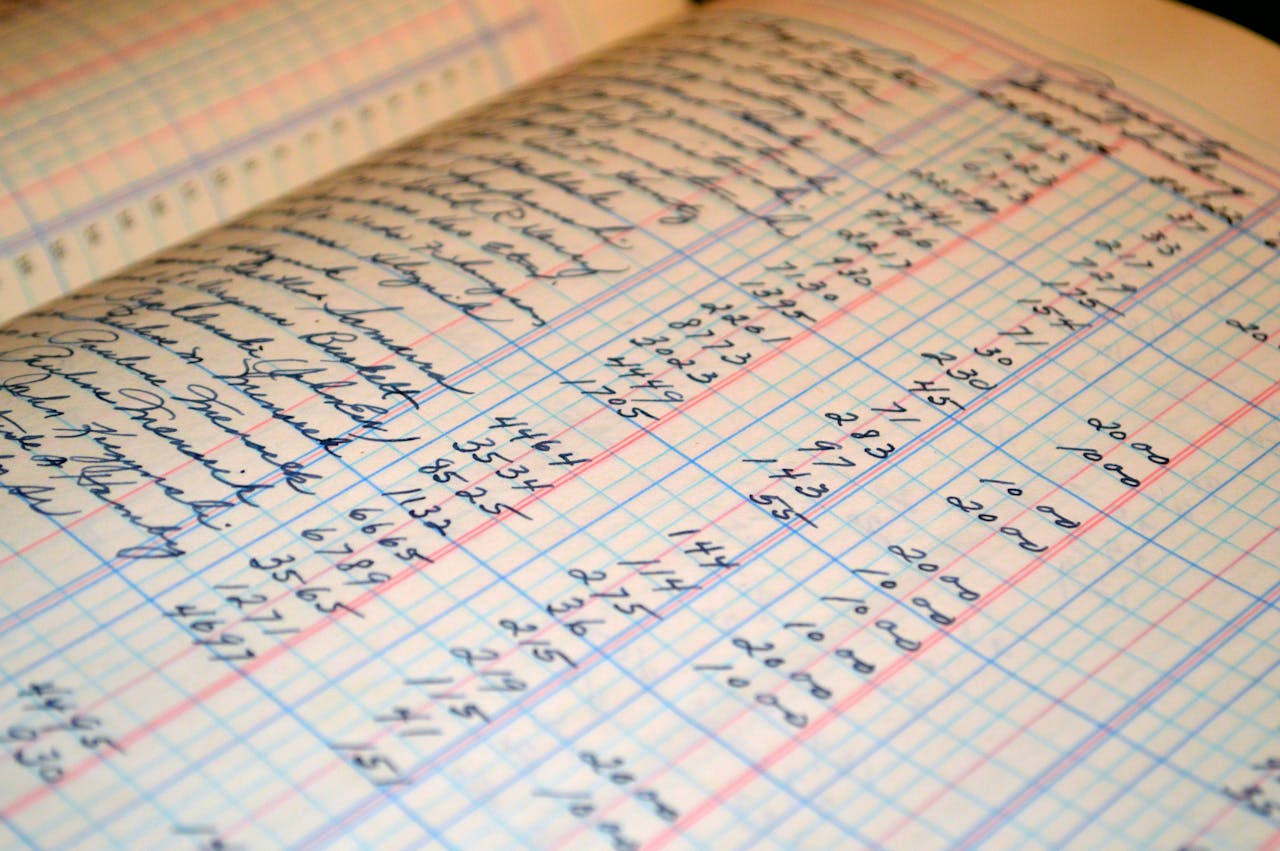

Documentation: Keeping detailed records of all transactions and sales for legal and tax purposes.

Challenges of Estate Liquidation

Emotional Difficulty: It can be emotionally challenging for family members to part with personal belongings.

Complex Valuation: Accurately appraising and selling diverse items can be complex and time-consuming.

Legal Compliance: Ensuring that all aspects of the sale comply with legal and tax requirements.

Professionals such as estate liquidators, attorneys, and financial advisors often assist with the process to ensure it is conducted efficiently and in accordance with legal requirements.